Step-by-Step Guide to Filing an Insurance Claim Smoothly

Submitting a claim with an insurance company can be stressful particularly when you are in the moment of a disaster whether it be an accident, health crisis, or a loss to your property. Knowing the process will make the experience of a claim a lot easier! Ultimately, the best way to protect your insurance contract is to be prepared and informed with all aspects of the claims process.

In this guide, we will give you a step-by-step guide about the process of filing a claim with your general insurance provider, so you are confident to manage it effectively.

Why does it matter to file an insurance claim properly?

When you make a purchase, you are buying financial protection, but that protection does not work if your insurance claims are not filed properly or on time. A properly documented claim will provide:

- Faster insurance payments.

- Fewer issues with your insurer.

- Peace of mind that your insurance coverage is being used for its intended purpose.

Step 1. Reviewing your insurance policy.

Prior to pursuing the actual claim, it is valuable to read your insurance policy closely. Understanding your coverage, exclusions and limitations is beneficial for avoiding disappointment later.

👉 Pro Tip: When possible, ensure to have a copy of your insurance information (policy, contact information and claims form) for any emergency.

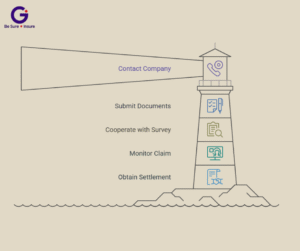

Step 2: Contact Your Insurance Company Right Away

Contact your property insurer to report the loss as soon as possible. This will start the insurance process in a timely manner and keep your process from being delayed, due to you not notifying them in a timely manner.

Most companies offer several ways to file a claim:

- by phone

- by email or online claim form

- via mobile app

Step 3: Gather and Submit Required Documents

Documentation is the backbone of a successful insurance claim. Depending on the type of claim (health, motor, home, etc.), you may need:

- Policy document

- Claim form (filled and signed)

- Identity proof

- Bills, receipts, or medical records

- FIR (in case of theft/accident)

- Photographs of damage

👉 Missing documents are one of the most common reasons for claim rejection.

Step 4: Cooperate During the Survey or Investigation

For many claims, the insurance company will assign a surveyor or investigator to assess the situation. Be honest, cooperative, and provide all requested insurance information.

- For health insurance: medical reports and hospital bills may be verified

- For motor insurance: vehicle inspection is usually conducted

- For property insurance: damage assessment is performed

Step 5: Monitor Your Claim and Follow Up

Once you’ve submitted your claim it’s important to stay proactive. Use your insurer’s online client portal or call their helpline to check the status of a claim. You should follow-up with them periodically so that your claim isn’t stalled.

👉 If it’s likely you will run into trouble with getting paid, then it’s worthwhile to speak with a trusted advisor like Insurance Guru to help the claims process along.

Step 6: Obtain Your Settlement

Once approved, the settlement will be processed by an insurance company. Depending on what type of a policy you have, this could be:

- Cashless settlement (the money goes directly to the hospital/garage)

- Reimbursement (you pay for the services upfront).

Common Mistakes to Avoid During an Insurance Claim

- Delaying claim intimation to your insurer

- Submitting incomplete documents

- Misrepresenting facts in the claim form

- Ignoring small print in your insurance policy

Avoiding these mistakes ensures faster approval and minimizes disputes.

Why Choose an Insurance Guru for Your Claims Process to be Easy?

Here at Insurance Guru led by Rahul Handa (Certified Insurance Broker), we are dedicated to making the claims process easy for all our clients here in Mohali and the rest of Punjab. We have more than 15 years’ experience of guiding you through each step, ensuring:

- Understanding of your Insurance Policy.

- Help with the preparation of documents that are accurately completed.

- Follow up with the claims regarding nothing unnecessary.

- Assuring you that you have taken all the benefit from your Insurance Policy.

Final Thoughts

The claims process does not need to be complicated. Insurance Claims can be made stress free through being informed and keeping organized, and being proactive to help get your insurance settlement. If you need an expert in insurance in Mohali, contact Insurance Guru today.